Is There a Limit Down Payment on Car Loan Malaysia

Any more than 20 is. But just because a lender offers a loan of 90 of the home price it doesnt mean that you must borrow that much.

Enter car price in Malaysian Ringgit.

. Its a good idea to put a down payment for the loan if youre able to as youll benefit from borrowing a smaller amount hence paying less interest. Auto debits will also be paused. Despite this maintaining that purchase is another story altogether.

The margin of financing with a conventional car loan is up to 90 of the vehicles price. Or find your next car amongst the quality listings at otomy. For 0 down payment loan period is fixed at 9 or 10 years may be more.

Enter car loan period in Years. Generate principal interest and balance loan repayment table by year. Enter down payment amount in Malaysian Ringgit.

Nope theres no limit on how much your down payment can be. They then buy a 475 sq ft unit where the installment is RM1540 a month. Estimate monthly car loan repayment amount.

Their debt-service ratio is a little above 50. They earn RM5000 a month and pay RM1000 a month in car loan installments. Assuming you have made full payments in the last 90 days you dont have to pay anything from April 2020 until September 2020.

This applies to bank loans in general but. I signed up six years repayment term and paid RM404 as monthly installment. But you can settle your car loan early and earn interest from FD and rebate from bank by Full Settlement I financed RM20000 to buy a Proton Saga in 1999.

Answered on Feb 28 2022. Generally you are given two options. For first-time homeowners in Malaysia lenders are usually able to provide a home loan of up to 90 of the homes purchase price.

Based on the principle of financing there are two types of car loans available for customers. With low or even zero down payments and long car loan tenures purchasing a car is accessible to most. Generate principal interest and balance loan repayment chart over loan period.

Depending on your salary you can repay your loan within 3 5 or 7 years. Lets say your car loans tenure period runs until January 2025. To lessen the amount of interest it is advised to pay a higher percentage upfront.

Car loans commonly offer a maximum margin of financing of 90 hence you are expected to pay 10 of the car value to the dealership. Down Payments A down payment is an initial payment that you make to book the car that you are interested in for purchase which usually cost a minimum of 10 for new cars 20 for used cars. So register with us today.

Down payment is subjected to car brand promotion and dealers offer. Buying a car in Malaysia is a relatively easy affair especially when it comes to the more affordable cars such as the Perodua Axia or Proton Saga. You could put 99 toward the loan finance the remaining 1 and that would be just fine.

As a general rule you should probably put down at least 20 on a new car as this will lower the amount of interest you pay over the life of the loan. Banks usually offer a maximum term of 9 years on the loan. If you are one of those who are looking to sell for the extra cash or buy a car with the extra cash you should totally check out Carsome.

Its simple free and easy. The 6-month moratorium simply means that your car loans tenure period will now be extended until July 2025. A conventional car loan provides an individual with funds to purchase a car.

For example if you were paying RM 300 including interest and your car payment is supposed to end in Sept 2020 you will pay RM 300including interest in October 2020 and your loan will end in March 2021. This means that the out-of-pocket down payment would be 10 of the purchase price. Generally speaking normally theyll ask for 10-15.

A A six-month moratorium on your loan which means you will not be making any payments for six months but will defer or postpone making payments until after the six-month period ends. Things you should know about hire purchase loans in Malaysia. If the fresh grad is to put a downpayment of 10 and take a five-year loan with an estimated interest rate of 3 they would be paying roughly RM404 per month RM303 for a seven-year loan or RM247 for a nine-year loan.

Use otomy to reach over 2000000 car buyers on Malaysias 1 automotive network. Or b A 50 per cent reduction in monthly loan installments for six months. The interest for car loan was 76 at that time very high but lower than few months before I took the loan.

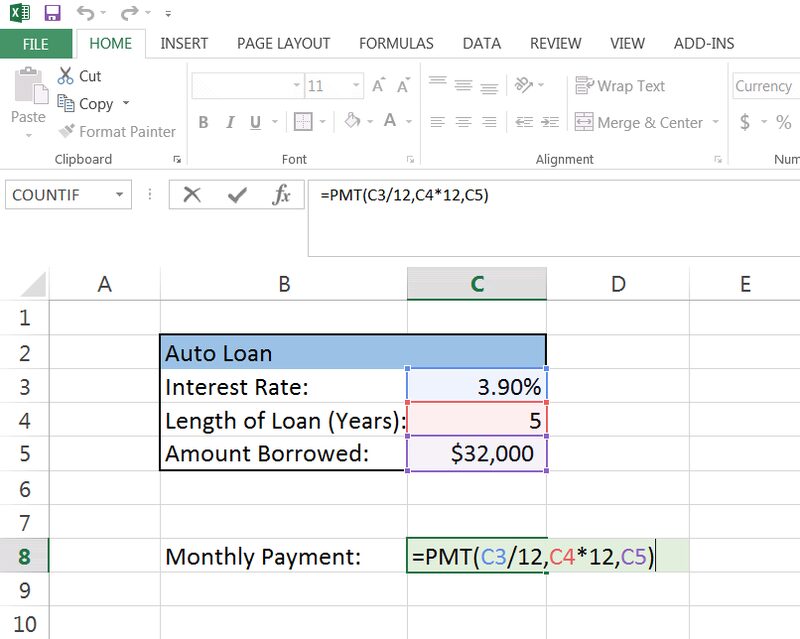

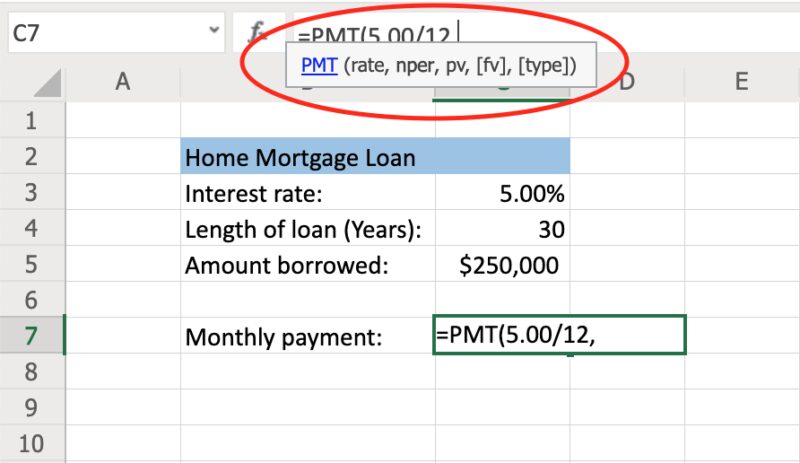

It covers all new used and unregistered and reconditioned cars. Interest Rate Loan Period In Years Monthly Payment.

How To Calculate Monthly Loan Payments In Excel Investinganswers

How To Calculate Monthly Loan Payments In Excel Investinganswers

Should I Make A Car Down Payment With A Credit Card

Amortization Table Real Estate Exam

0 Response to "Is There a Limit Down Payment on Car Loan Malaysia"

Post a Comment